Value Checks - Personal Checks Free Shipping

Super Saver Checks

Your search for high-quality personal checks at cheap prices ends here. Order classic parchment checks for maximum savings starting at $3.99 per pad of checks. Choose any personal check design from our Checks Unlimited Super Savers category including Disney Cartoons, Harley Davidson, or Stars & Stripes selling for $5.50 per box for first time customers and save up to 70% or more when you buy online. We back every order with our satisfaction guarantee.

Cheap Personal Checks

Free Shipping Checks Online

From patriotic designs to your favorite charity checks, our selection offers free shipping and unbeatable savings to express your unique style. Whether you prefer Classy Muscle Cars, Horse Play, or Inspirational Checks, we've got you covered with high-quality options. Discover a new design and see why our customers bypass the bank and choose Value Checks for their orders. With three-quarters of our checks featuring free shipping, you'll find exceptional value and variety in every purchase.

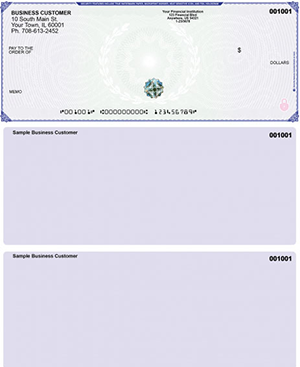

Cheap Business Checks

Elevate your business transactions with our Cheap Business Checks, designed to provide both affordability and professionalism. These high-quality checks come with advanced security features, ensuring your payments are safe and reliable. Available at prices significantly lower than banks, our business checks help you manage expenses without compromising on quality. Enjoy the added convenience of free shipping on many options, making Value Checks the smart choice for all your business check needs.

Checkbook Covers, Deposit Slips & Stamps

Complete your banking needs with our range of checking account accessories, including stylish checkbook covers, convenient deposit slips, detailed check registers, and efficient banking stamps. These high-quality accessories not only help you stay organized but also add a touch of professionalism to your financial management. Designed for durability and ease of use, our accessories ensure that you have everything you need to handle your banking tasks smoothly. Shop now and see why so many customers choose Value Checks for their checking account essentials.

Many Styles Of Inexpensive Personal Checks

Side Tear

Side Tear Styles are available in most personal check designs. Use easy Side Tear format.

Top Stub

Fill out top stub personal tracking records for each transaction. Over 190 Top Stub designs.

Address Labels

Colorful and practical address labels make mailing fun. Choose from over 5K address label designs at low prices.

Checkbook Covers

Select from a wide assortment of leather, vinyl or cloth checkbook covers.

Order Lowest Priced Checks Online With Free Shipping

Are you tired of the hassle of ordering checks through your bank? Welcome to Value Checks, where you can view a huge variety of checks from 5 different websites. We have built a site that has fully orgnized

checks from many of the top brands of checkk printing companies. We want you to be able to find your checks at the right price from the right company. We pride ourselves on providing our customers with high-quality personal and business checks, all from the comfort of your home. With Value Checks, you can easily order checks online and have them delivered straight to your door with free shipping!

Why Buy Checks From Value Checks?

| | Our popular parchment checks sell for only $3.99 a box. Your order includes 100 checks per box, 25 per pad, deposit tickets, and a check register. You can get this deal every day of the week. This is at least a 70% savings off regular bank prices. |

| | High Security Blue Checks are only $7.45 per box. Sales are going on throughout the month. Includes free registers and deposit slips from Bradford Exchange Checks |

| | Thomas Kinkade Checks start at an amazing low price of $5.50 - $7.45. No need to use coupon codes on this premier discounted offer. |

Best Selection of Eye-Catching Check Designs

Explore our vast collection of beautiful and unique check designs. Whether you’re a sports enthusiast, nature lover, or looking for something fun and quirky, we have the perfect design for you. Some of our categories include:

We guarantee you’ll find a check design that suits your personality and style.

Order Cheap Checks With Free Shipping Online

Nothing is more frustrating than unexpected shipping fees. At Value Checks, many of our trusted check printing partners offer free shipping with no hidden fees. For example, Check Advantage provides both free shipping and no handling fees. Visit our coupon page for the latest discounts, including offers like:

Easy & Secure Personal & Business Check Ordering

Ordering checks online is straightforward. Whether you order personal checks or you want to purchase business checks, you will go through the same procedure. Simply have your bank account information ready:

- Routing Number: The bank branch and location.

- Account Number: Your personal bank account number.

- Check Number: The starting number for your new checks.

Customize checks with unique fonts and logos to make them truly personal. Security is our top priority. Our partner, Carousel Checks, offers advanced security features like holograms and chemical stains to prevent fraud. Rest assured, your order is protected every step of the way.

Value Checks is your number one source for the best, cheapest checks online. We are also known for sending you checks in the mail like business checks. Even ourcheckbook covers, check registers and address labels come in the mail. Overall, it's very easy and secure to order discounted checks online.